Antitrust Law (2024)

Laws against anticompetitive practices

There are a variety of antitrust laws in the United States that are designed to promote free and fair competition. The federal and state governments each have their own versions and interpretations of antitrust law. The Department of Justice (Antitrust Division) is the chief enforcer of the United States’ antitrust laws, although private litigants also play a crucial role.

Antitrust Law Definition

Antitrust laws are statutes or regulations designed to promote free and open markets. Also called “competition laws,” antitrust laws prohibit unfair competition. Competitors in an industry cannot use certain tactics, such as market division, price fixing, or agreements not to compete. And companies cannot abuse their monopoly power to force smaller competitors out of business.

Antitrust Laws Examples

There are many examples of antitrust laws at both the federal and state level.

Some federal antitrust law examples include: the Sherman Antitrust Act and the Clayton Antitrust Act. The Sherman Act prohibits agreements among companies not to compete (such as by fixing the price of the products they sell). The Clayton Act was designed to prevent mergers and acquisitions that consolidate too much market power in one company.

Some state antitrust law examples include: the California Cartwright Act and New York Donnelly Act.

And some common examples of illegal practices that are prohibited under antitrust laws are: price fixing and market division.

What are the three major antitrust laws?

The three major antitrust laws in the U.S. are:

- the Sherman Act;

- the Clayton Act; and

- the Federal Trade Commission Act (FTCA).

History of Antitrust Laws

According to the Federal Trade Commission’s (FTC’s) Brief History of Antitrust Laws:

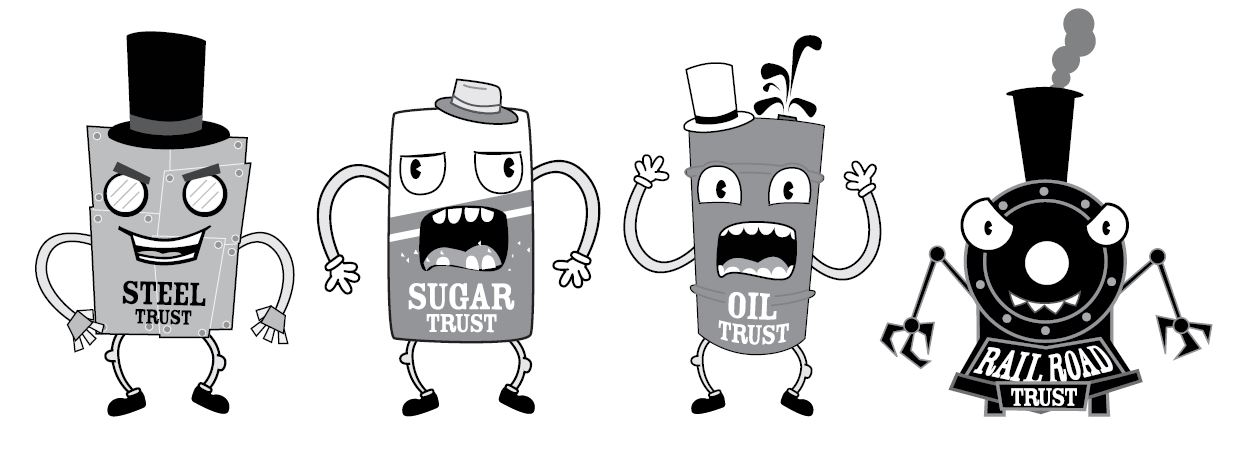

Once upon a time, way back in the 1800s, there were several giant businesses known as “trusts.” They controlled whole sections of the economy, like railroads, oil, steel, and sugar. Two of the most famous trusts were U.S. Steel and Standard Oil; they were monopolies that controlled the supply of their product—as well as the price. With one company controlling an entire industry, there was no competition, and smaller businesses and people had no choices about from whom to buy. Prices went through the roof, and quality didn’t have to be a priority. This caused hardship and threatened the new American prosperity.

While the rich, trust-owning businessmen got richer and richer, the public got angry and demanded the government take action. President Theodore Roosevelt “busted” (or broke up) many trusts by enforcing what came to be known as “antitrust” laws. The goal of these laws was to protect consumers by promoting competition in the marketplace.

Congress passed the Sherman Act, the nation’s first antitrust law, in 1890. The Sherman Act made it illegal for companies to enter agreements not to compete (such as price fixing) or abuse monopoly power.

Congress passed the Clayton Act in 1914. As the FTC explains:

With the Sherman Act in place, and trusts being broken up, business practices in America were changing. But some companies discovered merging as a way to control prices and production (instead of forming trusts, competitors united into a single company.

The Clayton Act helps protect American consumers by stopping mergers or acquisitions that are likely to stifle competition.

Also in 1914, Congress passed the Federal Trade Commission Act, which set up a new federal agency — the Federal Trade Commission — to enforce the FTC Act, which broadly prohibited unfair and deceptive trade practices that harm consumers (such as false advertising).

Why are they called antitrust laws?

During the late 1800’s, a trust was a common way for business interests to unite into a conglomerate. Standard Oil’s general counsel first conceived of the corporate trust to help John D. Rockefeller consolidate his control over the many oil companies that he had acquired. The Standard Oil Trust ended up owning 14 oil companies, and was the majority shareholder of 26 other oil companies.

With the passage of the Sherman Antitrust Act in 1890 and aggressive trust-busting by the states as well, the corporate trust fell out of favor. The Standard Oil Trust, for example, terminated its own trust agreement in March 1892. Corporations soon found other ways of consolidating into conglomerates through the use of holding companies.

What is a violation of antitrust laws?

Three typical types of antitrust law violations are:

- agreements not to compete;

- monopolization;

- tying.

An agreement not to compete may occur when competitors meet up and agree not to compete with each other price (called price fixing) or agree not to compete with each other in certain geographic regions (called market division).

Monopolization occurs when a company with significant market power (generally, more than 70 percent market share) abuses its monopoly power to harm competitors. It’s not inherently illegal for a monopoly to exist. But a monopoly may not, for example, be able to require purchasers of its products to agree — as a condition of purchase — not to ever buy products from the monopolist’s competitors.

Tying occurs when a company uses its monopoly power in one market to try to gain market share in another market by tying the purchase of its popular product to its less popular product. For example, the coffee maker Keurig was accused of tying when it released version 2.0 of its Keurig machine, which only worked with Keurig-brand coffee pods. Some believed that Keurig was using its monopoly power in the market for coffee-making machines to force consumers to buy its coffee pods.

What is the purpose of antitrust laws?

Antitrust laws are designed to protect consumers from anti-competitive business practices. If antitrust laws did not exist, competitors could meet with each other and agree not to compete with each other on price or quality. If all competitors in an industry reach such an agreement, consumers are forced to accept higher prices or lower quality products because they have no other choices.

Companies are not punished under antitrust law for being successful. Monopolies often form through legitimate competition, simply because the company offers a superior product or service.

Antitrust laws are designed to stop companies from using tactics that don’t benefit consumers (such as price fixing or market division).

Why is antitrust law important?

Before passage of antitrust laws in the late 1800’s and early 1900’s, corporate consolidation led to the worst abuses of the Gilded Age. Entire industries were essentially consolidated into one giant “trust” company. For example, the oil industry was consolidated into the Standard Oil Trust, and the tobacco industry was consolidated into the American Tobacco Company. Political corruption was rampant, as these enormous trusts utilized their massive bankrolls to bribe politicians to avoid any form of government regulation. As consumers grew tired of unfair corporate tactics and political corruption, a populist movement swept the nation. President Teddy Roosevelt ran on a platform of “trust-busting,” and Congress passed strong antitrust protections.

Antitrust law recognizes that there are both good and bad forms of competition. Antitrust law is designed to prevent only bad forms of competition, where the anti-competitive effects of a business practice outweigh the pro-competitive efficiencies.

Learn More about Antitrust Law

About Us

Antitrust Law Question?