Eileen Epstein Carney

Eileen works closely with investors in securities cases and has over a decade of experience in the legal world. She received her law degree from American University in 2005.

Our law firm is investigating possible legal claims on behalf of Mallinckrodt investors.

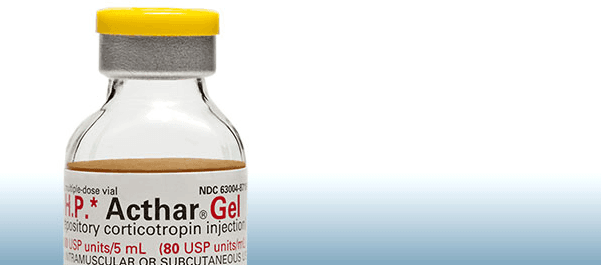

Mallinckrodt plc (NYSE: MNK) stock plummeted after it announced that a dispute with health regulators could cost it hundreds of millions of dollars and reduce future sales of Acthar, one of its top-selling products. The stock previously suffered a massive drop when it was reported that a whistleblower lawsuit would accuse Questcor, a company that Mallinckrodt previously acquired, of paying kickbacks.

In total, shares of MNK have declined by about 38% in 2019. If you’re a Mallinckrodt investor, we may be able to help you recover your losses.

Recover your MNK stock losses

You may be able to recover your stock losses in a securities lawsuit. Free consultations.

According to an article in the Wall Street Journal on May 21, 2019, Mallinckrodt filed a lawsuit against the Department of Health and Human Services after the Centers for Medicare and Medicaid Services had determined Mallinckrodt would have to pay additional money to states due to a change in the base date average manufacturer price for its injected drug, Acthar.

Mallincrkodt estimated it may have to provide as much as $600 million in retroactive rebates if the lawsuit was not successful, according to the article.

A Bloomberg article also noted that Berenberg analyst Patrick Trucchio slashed his price target in half to $5, stating:

“’The timing of this disclosure is potentially problematic’as the company doesn’t seem to have warned investors of this risk despite its disagreement with the government dating back to 2016, Trucchio said in a note to clients.”

On this news, share price fell nearly 25% to close at $9.87 on May 21, 2019.

Prior to that, on May 1, 2019, the Wall Street Journal published an article entitled, “Government to File Complaint After Mallinckrodt Unit Is Accused of Bribery to Drive Drug Sales.” The article reported that Questcor, which Mallinckrodt acquired in 2014, “defrauded government health-care plans by illegally marketing H.P. Acthar Gel.”

The article further states that whistleblowers alleged that the company paid doctors kickbacks through bribes, consulting agreements and speaking fees if they prescribed Acthar.

On this news, Mallinckrodt’s share price fell by more than 16%.

Our securities lawyers have recovered over a billion dollars on behalf of our clients against behemoths, such as Chase Bank, Mastercard, and Anthem Blue Cross Blue Shield. Read more about our results.

You “shouldn’t presume that powerful banks and other powerful interests can just get away with doing bad things. Good, qualified counsel that are committed to a cause can usually figure out how to prosecute such cases effectively and prevail.”

–Eric Gibbs, award-winning securities attorney

Federal judge in our AT&T class action:

“I’ve always found them to be extraordinary counsel in terms of their preparation and their professionalism.”

Federal judge in our Chase lawsuit (resulting in $100 million settlement):

They “fought tooth and nail, down to the wire” to achieve “the best settlement that they could under the circumstances.”

Read more about what judges say about us.

Eileen works closely with investors in securities cases and has over a decade of experience in the legal world. She received her law degree from American University in 2005.

David’s advocacy has generated major recoveries for consumers impacted by financial fraud. He was named to the Top 40 Under 40 by Daily Journal and a “Rising Star in Class Actions” by Law360.

Amanda is spearheading a securities lawsuit against NantHealth concerning fraudulent statements to investors about the success of its key product.