SEC Whistleblower

Report financial fraud and earn rewards

According to the 2010 Dodd-Frank Act, an SEC whistleblower is any individual, or group of individuals, who voluntarily provide information to the government relating to securities law violations.

There are various types of violations of federal securities law about which a whistleblower might have information. A whistleblower might become aware of:

- Accounting fraud

- Insider trading

- Bribing a foreign official

All of these are violations of federal securities law, but there are many other types of violations as well. Federal securities law is vast, and the SEC is constantly crafting new rules.

One of the most common violations is making a material misstatement to investors, in violation of the Sarbanes-Oxley Act.

Want to become an SEC whistleblower?

Our whistleblower attorneys can help you apply for an SEC whistleblower award. Consultations are free and confidential.

How SEC Whistleblowing Works

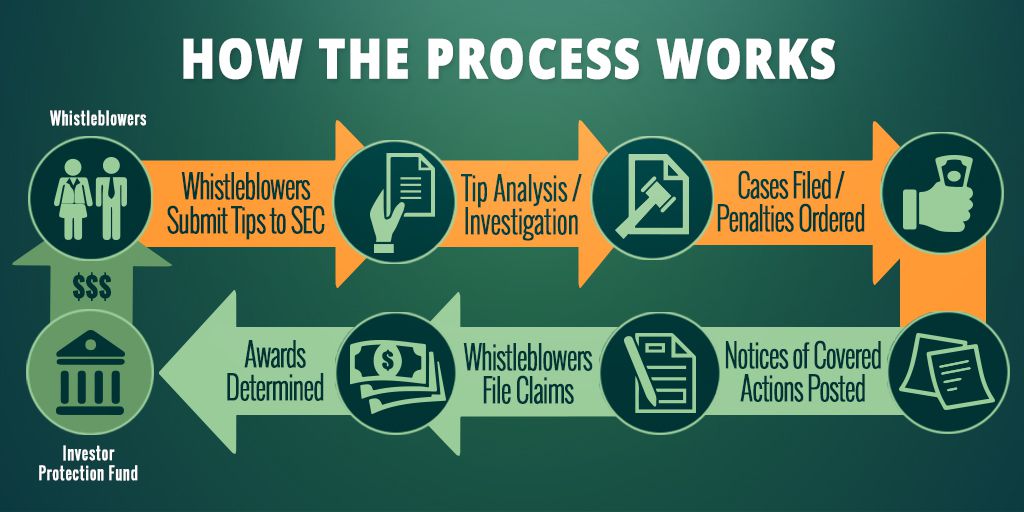

The SEC whistleblower process proceeds in stages:

First, the whistleblower submits a tip to the SEC.

Second, the SEC analyzes the tip, and if the tip has some merit, the SEC may conduct its own independent investigation. If the SEC decides to go forward, it will file an enforcement action. If the enforcement action is successful, penalties will be ordered.

Next, the SEC will post the final judgment on its website under Notices of Covered Actions. A “covered action” is any action that results in penalties exceeding $1 million.

The whistleblower who submitted the tip (or their lawyer) must frequently check the list of covered actions to see if one of them is related to the whistleblower’s tip. If the whistleblower finds a covered action related to their tip, they can file a claim asking for a portion of the recovery. The SEC then determines how much of the award to give the whistleblower.

- Compiling the information in the tip in a way that increases the likelihood the SEC will pursue the case

- Drafting the whistleblower’s claim for an award at the end of the process

An attorney-drafted claim is usually more likely to lead to a higher whistleblower award.

SEC Whistleblower Awards

The SEC whistleblower reward program was established by the Dodd-Frank Act, which was signed into law by President Obama in 2010.

Under the act, SEC whistleblowers are entitled to a minimum of 10% and a maximum of 30% of the money recovered by the government, if their original information leads to a successful SEC enforcement action resulting in monetary sanctions exceeding $1 million.

- How significant the whistleblower’s tip was in helping secure the final judgement

- How much the whistleblower assisted during the investigation and enforcement proceeding (such as whether the whistleblower testified as a witness)

- The SEC’s interest in giving whistleblowers large awards to deter companies from violating the securities laws

- Whether the whistleblower also reported the violation internally or whether the whistleblower instead hindered the company’s internal compliance process

- Whether the whistleblower participated in any way in the securities violations

- Whether the whistleblower unreasonably delayed in reporting the fraud to the SEC

Over $130 Million Paid to SEC Whistleblowers

Since the SEC whistleblower program’s inception in 2011, the program has paid over $130 million in whistleblower awards. Because the SEC keeps any information about its whistleblowers confidential, little is known about the specifics of each enforcement action that led to a whistleblower award.

However, the top five SEC whistleblower awards since 2011 are:

- $30 million

- $22 million

- $20 million

- $17 million

- $14 million

SEC Whistleblower Retaliation & Protection

Dodd-Frank requires the SEC to keep confidential any information that might reasonably be used to discover the identity of a whistleblower.

In addition to strict confidentiality protections, the Dodd-Frank Act also makes it unlawful for a company to retaliate against an employee for whistleblowing to the SEC.

Dodd-Frank says:

No employer may discharge, demote, suspend, threaten, harass, directly or indirectly, or in any other manner discriminate against a whistleblower in the terms and conditions of employment …

An SEC whistleblower who is wrongfully terminated is entitled to reinstatement at the same seniority-level the whistleblower would have had but for the termination. The whistleblower is also entitled to twice the amount of wages they would have earned in the period in which they were out of a job. Lastly, the whistleblower is entitled to reimbursement for all litigation costs and reasonable attorneys’ fees spent in pursuit of remedying the wrongful retaliation.

Who Can Be An SEC Whistleblower?

In general, anyone who has original information about a possible violation of federal securities law can be an SEC whistleblower. A whistleblower who has original information possesses either of the following:

- independent knowledge

- independent analysis of which the SEC is not aware

Independent knowledge means knowing facts that are not publicly available. Independent analysis means evaluating the known information in a novel way that reveals something new about the potential violation of federal securities law. Independent analysis can include facts derived from public sources, such as newspapers or government websites, but independent knowledge cannot be derived from public sources of information.

While whistleblowers do not have to be corporate insiders, it may certainly help in acquiring non-public information about corporate wrongdoing.

Some examples of people who can blow the whistle on SEC fraud include:

- A company-insider, such as an employee or mid-level manager

- A customer of the corporation

- A business associate of the corporation

- A vendor of the corporation

- An outside advisor

- Someone who hears the information second-hand from a friend who works at the company

Report an SEC violation

Who Cannot Be An SEC Whistleblower?

The following entities and individuals are barred from bringing an SEC whistleblower claim:

(1) Corporations

Only natural persons are permitted to be SEC whistleblowers.

(2) Members of the Board of Directors or corporate officers (such as the CEO, CFO, President, etc.)

SEC rules specifically disqualify these high-level individuals from being whistleblowers (except in limited circumstances).

(3) Compliance officers, lawyers, external or internal auditors

SEC rules disqualify anyone who learns the “original information” as part of the corporation’s internal process for reporting, investigating, and auditing its compliance with federal securities law (except in limited circumstances). [In contrast, under the False Claims Act, courts have allowed auditors, compliance officers, and even lawyers to be whistleblowers.]

Even if barred from being an SEC whistleblower, these individuals can still report securities violations internally by calling their company’s SOX whistleblower hotline.

SEC Enforcement Actions

An enforcement action is a purely administrative suit that the Securities & Exchange Commission files and tries in front of the Commission itself. The SEC Commissioners take on the role that a judge and jury would normally have in a civil lawsuit.

The SEC can bring an enforcement action whenever it wants. An SEC enforcement action might be based on a whistleblower tip, information that the SEC obtained through other investigative means (such as from the FBI), or publicly available information.

Because the SEC keeps information about its whistleblowers strictly confidential, the SEC will not disclose which of its enforcement actions were based on whistleblower tips.

However, here is a list of some of the SEC’s top enforcement actions that provide a sense of what kinds of enforcement actions the SEC brings:

- In February 2010, the SEC charged Bank of America with misleading investors about problems surrounding Bank of America’s acquisition of Merrill Lynch. The SEC alleged that Bank of American had misled investors about the billions of dollars in bonuses being paid to Merrill Lynch executives and failed to disclose extraordinarily large losses that Merrill Lynch had sustained.

- In April 2010, the SEC charged Goldman Sachs with misstating and omitting key facts about one of its financial products which was tied to the subprime mortgage crisis. Goldman Sachs settled the SEC’s charges by paying $550 million in penalties.

- In October 2011, the SEC charged Citigroup with misleading investors by putting together $1 billion in mortgage-backed securities and then taking a short position against the very same securities, so that Citigroup would benefit if the securities failed. Citigroup agreed to settle the SEC’s charges for $285 million.

- In December 2011, the SEC charged seven former Siemens executives for a decade-long bribery scheme that helped Siemens retain a $1 billion contract from the Argentinian government.

- In November 2012, the SEC brought an enforcement action against British Petroleum (BP) for misleading investors about the amount of oil that had leaked into the Gulf of Mexico due to the Deepwater Horizon oil rig explosion. BP settled the SEC’s charges by paying $525 million in penalties.

Submitting a Tip to the SEC

If you plan to seek the assistance of an attorney, do so before submitting your tip, since your attorney can provide a great deal of help and insight in helping you draft the tip to increase the chances that the SEC will investigate your information further.

SEC whistleblowers can submit tips in one of two ways:

- Through the SEC’s online portal

- By filling out this form and mailing or faxing it to:

SEC Office of the Whistleblower

100 F Street NE

Mail Stop 5631

Washington, DC 20549

Fax: (703) 813-9322

Learn More about SEC Whistleblowing

Our SEC Whistleblower Attorneys

Eric Gibbs

Eric prosecutes financial fraud and other mass torts matters. He has recovered billions of dollars for clients and led high profile class actions.

View full profileDylan Hughes

Dylan concentrates his practice on investigating and prosecuting fraud matters on behalf of whistleblowers, consumers, and employees.

View full profileAmy Zeman

Amy has built a reputation in the plaintiffs’ bar for delivering results to consumers and sexual assault survivors in class actions and mass torts.

View full profileAaron Blumenthal

Aaron represents consumers, employees, and whistleblowers in class actions and other complex litigation.

View full profileAbout Us

Consult an SEC whistleblower attorney:

Consultations are at no cost.